Equity crowdfunding in the United States is a blank slate. With equity crowdfunding’s recent legalization in the United States, many companies smell an opportunity to develop technical and financial innovations to help the industry mature.

Equity crowdfunding is much like crowdfunding, which has been popularized in the United States through sites such as Kickstarter and Indiegogo. The difference is that instead of individuals supporting campaigns through donations, numerous investors are purchasing small stakes in startups or small businesses. Critics of crowdfunding worry that the industry will be rife with Ponzi schemes or that having too many investors will hurt startups’ prospects for future funding.

Proponents of equity crowdfunding, however, point to its success in countries such as Australia and Germany. For example, Seedmatch, an equity crowdfunding platform in Germany, allows investors to enter long-term investment contracts where they get equity. Australia, where equity crowdfunding has been legal for seven years, already has a platform for “secondary” sales of unlisted issued securities.

Currently, equity crowdfunding in the United States lacks the organizations and support infrastructure, such as investor verification systems and clearing houses, needed for a thriving equity crowdfunding ecosystem.

“We are already beginning to experience the proliferation of financial innovation with secondary exchanges, investor verification systems and private securities-clearing,” Crowdnetic CEO Luan Cox said. “I believe that as the infrastructure matures, more and more financial service providers will adopt crowdfinance and the industry will rapidly develop into a viable asset class.”

Companies such as Finagraph are helping investors cut through the opaque fog often associated with investing in startups. They provide a portal that will allow investors to analyze companies’ current financial health. According to MIT Profssor Christian Catalini, creating more transparency and developing trust will be essential for equity crowdfunding’s success.

“It will be interesting to see how the ecosystem around equity crowdfunding platforms will evolve,” he said. “There is an opportunity for third-party intermediaries to provide certification (e.g., on the technical feasibility of an hardware project) and quality ratings in the market to improve its efficiency. A trustworthy intermediary would increase the number of transactions that can actually take place. Platforms will experiment with different forms of market design and rules, in an effort to select only projects that meet a certain quality level.”

Catalini already sees some healthy equity crowdfunding experimentation that will help the industry mature.

“This will spawn a number of innovations, as traditional institutions and new ones start experimenting with how to bring crowdfunding to the next level,” he continued. “We will see some failures, and we will learn from them in an effort to develop better regulation. It will be interesting to see how crowd due diligence on projects will evolve, as right now it mostly relies on one or a few lead investors taking the lead on the activity. Interestingly, platforms like AngelList are already experimenting with ways to encourage talented investors to use their skills and scale their operations by allowing others to co-invest, and incentives are aligned because they get a carry on the investment.”

One glaring obstacle, according to Director of Research Richard Swart, who oversees crowdfunding research at Berkeley, is the lack of crowdfunding auditors.

“There also needs to be a better way of doing financial audits,” Swart said. “There’s a big gap in the market when it comes to auditing small businesses or early-stage startups. The Big Four accounting firms just don’t have it covered yet. Most startups don’t have great financial accounting. It will take some time for the market to mature. You will probably see institutional investors experiment with equity crowdfunding before you see individual investors. 90% of America doesn’t even know what equity crowdfunding is.”

Swart believes equity crowdfunding will be attractive to “Main Street USA” businesses with loyal customers, but especially attractive to tech startups that do not want to deal with venture capital funds.

“I wouldn’t be surprised if we saw large pools of investment, say 20-40 million dollars,” he said. “They might just find that the costs of capital are much lower with equity crowdfunding. It’s better than dealing with VCs. A lot of people are worried that equity crowdfunding might create problems for startups who later want to seek venture capital money. However, you might see a new convertible instrument, where instead of debt being converted to equity, you will see equity turned into debt. The debt will have a much higher interest rate, so as to make it attractive to the earlier investors, and so that VCs will be wiling to invest in certain companies.”

While opportunities in equity crowdfunding exist, University of Virginia Law Professor Edmund Kitch warns that simpler securities laws are necessary for equity crowdfunding to truly thrive.

“If crowdfunding is to flourish the most obvious need is for a skillfully curated web site that will review projects and their promoters to ensure that they are honest and have the basic skills to succeed,” he said. ”Such web sites are unlikely to develop if the government stands in the way. If the government would simply create an open space for crowdfunding sites to operate, it could monitor their development and if it identified specific problems that create the need for targeted legal intervention, it could then pursue that intervention. Unfortunately, the JOBS Act is enacted within the regulatory complexity of current securities law, and does not accomplish this simple goal.”

Read More From NerdWallet:

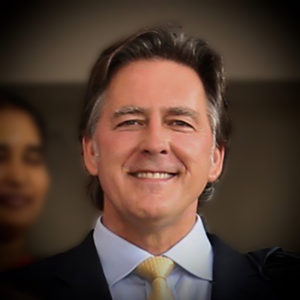

Scott McIntyre. 2024 marked Scott’s 9th term as Chairman of the CfPA’s Board of Directors, having served in leadership since formation in 2012, including four terms as President & Chair.

Scott McIntyre. 2024 marked Scott’s 9th term as Chairman of the CfPA’s Board of Directors, having served in leadership since formation in 2012, including four terms as President & Chair.

Jenny Kassan has almost three decades of experience as an attorney and advisor for mission-driven enterprises. She has helped her clients raise millions of dollars from values-aligned investors and raised over $3 million for her own businesses.

Jenny Kassan has almost three decades of experience as an attorney and advisor for mission-driven enterprises. She has helped her clients raise millions of dollars from values-aligned investors and raised over $3 million for her own businesses. Brian is the Founder of Crowdwise, LLC, and is an angel investor in 80+ private startups through equity crowdfunding.

Brian is the Founder of Crowdwise, LLC, and is an angel investor in 80+ private startups through equity crowdfunding.

Patrick Tracey is Director of Business Development for Morrow Sodali. In this role, Pat brings expertise in a number of areas including Proxy Solicitation – Activism – Corporate Governance Advisory – IPO Prep – Demutualization (Insurance Companies, Community Banks and Credit Union) – Stock Surveillance for Public, Private and Mutual companies.

Patrick Tracey is Director of Business Development for Morrow Sodali. In this role, Pat brings expertise in a number of areas including Proxy Solicitation – Activism – Corporate Governance Advisory – IPO Prep – Demutualization (Insurance Companies, Community Banks and Credit Union) – Stock Surveillance for Public, Private and Mutual companies. Blaine McLaughlin is the Chief Product Officer of VIA Folio, an innovative IPO, private and alternative investment platform that makes it easy for online platforms, issuers, investors, brokers and advisors to engage with IPOs, private and alternative debt and equity offerings. Part of Folio Investments, Inc., VIA Folio supports issuance, custody, servicing and secondary transactions in public and private equity and debt investments, and other listed and unlisted securities. McLaughlin joined the company in 2007, and has led retail customer acquisition and management, partnerships, portfolio acquisition, introducing broker services, and other business development activities.

Blaine McLaughlin is the Chief Product Officer of VIA Folio, an innovative IPO, private and alternative investment platform that makes it easy for online platforms, issuers, investors, brokers and advisors to engage with IPOs, private and alternative debt and equity offerings. Part of Folio Investments, Inc., VIA Folio supports issuance, custody, servicing and secondary transactions in public and private equity and debt investments, and other listed and unlisted securities. McLaughlin joined the company in 2007, and has led retail customer acquisition and management, partnerships, portfolio acquisition, introducing broker services, and other business development activities. Jordan Fishfeld is the former CEO and co-founder of PeerRealty (sold), and current Chairman of the Board and co-founder of CFX Markets and OpenFinance Network, secondary market platforms for traditionally crowdfunded and digital assets, respectively. In this role, he focuses his time on strategic planning and general oversight in the new and growing digital marketplace. With over 8 years of compliance, legal, investing, and sales experience in regulated markets, Jordan understands the need for a single coherent voice in the crowdfunding and blockchain industries.

Jordan Fishfeld is the former CEO and co-founder of PeerRealty (sold), and current Chairman of the Board and co-founder of CFX Markets and OpenFinance Network, secondary market platforms for traditionally crowdfunded and digital assets, respectively. In this role, he focuses his time on strategic planning and general oversight in the new and growing digital marketplace. With over 8 years of compliance, legal, investing, and sales experience in regulated markets, Jordan understands the need for a single coherent voice in the crowdfunding and blockchain industries. Over 35 years of experience in Information Technology with the majority of time being spent in the Financial Services industry. Possesses detailed knowledge of all aspects of the online capital formation/crowdfunding, international brokerage, hedge fund and asset management businesses. Able to recruit and motivate strong teams capable of solving mission critical business problems.

Over 35 years of experience in Information Technology with the majority of time being spent in the Financial Services industry. Possesses detailed knowledge of all aspects of the online capital formation/crowdfunding, international brokerage, hedge fund and asset management businesses. Able to recruit and motivate strong teams capable of solving mission critical business problems. Devin is a journalist, author and educator. He calls himself a champion of social good. As a new-media journalist and founder of the Your Mark on the World Center, Devin has established himself as a champion of social good. As a Forbes contributor, with over 400 bylines and over

Devin is a journalist, author and educator. He calls himself a champion of social good. As a new-media journalist and founder of the Your Mark on the World Center, Devin has established himself as a champion of social good. As a Forbes contributor, with over 400 bylines and over Vincent Molinari is the CEO of Templum Markets, (FINRA Registered Broker Dealer and ATS) and Co-Founder of it’s parent company, Templum, Inc. He is also a Co-Founder and Co-Chair of the Blockchain Commission for Sustainable Development and is a Co-Founder and Co-Chair of Blockchain for Impact.

Vincent Molinari is the CEO of Templum Markets, (FINRA Registered Broker Dealer and ATS) and Co-Founder of it’s parent company, Templum, Inc. He is also a Co-Founder and Co-Chair of the Blockchain Commission for Sustainable Development and is a Co-Founder and Co-Chair of Blockchain for Impact. David N. Feldman concentrates his practice on corporate and securities law and mergers and acquisitions, as well as general representation of public and private companies, entrepreneurs, investors, and private equity and venture capital firms. Mr. Feldman also advises emerging growth companies with regard to alternatives to traditional financing through initial public offerings. He is also considered an authority on public offerings through the recently implemented SEC Regulation A+. Mr. Feldman also represents investors, social media sites, public and private issuers and applicants for grow and dispensary licenses in the emerging cannabis industry.

David N. Feldman concentrates his practice on corporate and securities law and mergers and acquisitions, as well as general representation of public and private companies, entrepreneurs, investors, and private equity and venture capital firms. Mr. Feldman also advises emerging growth companies with regard to alternatives to traditional financing through initial public offerings. He is also considered an authority on public offerings through the recently implemented SEC Regulation A+. Mr. Feldman also represents investors, social media sites, public and private issuers and applicants for grow and dispensary licenses in the emerging cannabis industry. Alon is the Managing Partner of Stacked Capital, an early-stage industry agnostic venture capital fund. Previously Alon was the co-founder, Chief Financial Officer, and Chief Technical Officer of crowdfunding platform RocketHub, acquired in 2015. Alon is a founding member of the Forbes Technology Council, and a Strategic Advisor to Zombie Soup (Artificial Intelligence, Virtual Reality, and games); he has twice testified in front of U.S. Congress on equity crowdfunding, co-authored three acclaimed whitepapers on the JOBS Act, and was selected to lead FINRA’s Capital Markets Series on crowdfunding. Alon oversaw RocketHub’s partnerships with the White House, U.S. Department of State, Fulbright Foundation, Cisco, Microsoft, Chrysler, and others. Alon has led large speaking engagements for organizations including American Express, TEDx, Campaign Summit, Re.Comm, and Make Innovation. Alon earned his M.Sc from Columbia University and was a fellow at the Earth Institute’s Advanced Consortium of Cooperation, Conflict, and Complexity; he specialized in genocide prevention and social network theory.

Alon is the Managing Partner of Stacked Capital, an early-stage industry agnostic venture capital fund. Previously Alon was the co-founder, Chief Financial Officer, and Chief Technical Officer of crowdfunding platform RocketHub, acquired in 2015. Alon is a founding member of the Forbes Technology Council, and a Strategic Advisor to Zombie Soup (Artificial Intelligence, Virtual Reality, and games); he has twice testified in front of U.S. Congress on equity crowdfunding, co-authored three acclaimed whitepapers on the JOBS Act, and was selected to lead FINRA’s Capital Markets Series on crowdfunding. Alon oversaw RocketHub’s partnerships with the White House, U.S. Department of State, Fulbright Foundation, Cisco, Microsoft, Chrysler, and others. Alon has led large speaking engagements for organizations including American Express, TEDx, Campaign Summit, Re.Comm, and Make Innovation. Alon earned his M.Sc from Columbia University and was a fellow at the Earth Institute’s Advanced Consortium of Cooperation, Conflict, and Complexity; he specialized in genocide prevention and social network theory. Jason Paltrowitz is Executive Vice President and Global Head of Business Development at OTC Markets Group, where he is responsible for all international and domestic corporate services new business and relationship management. Prior to joining OTC Markets in October 2013, Mr. Paltrowitz was Managing Director and Segment Head at JP Morgan Chase and was responsible for the custody, clearing and collateral management business in the Corporate and Investment Bank division. Mr. Paltrowitz started his career at BNY Mellon serving in multiple senior management positions, most notably as Head of M&A for the Financial Markets and Treasury Services Sector and 11 years in the Depositary Receipt Division as the Head of the Global Capital Markets Group. Mr. Paltrowitz also served as a member of the Board of Directors at OTC Markets Group from 2008 – 2011.

Jason Paltrowitz is Executive Vice President and Global Head of Business Development at OTC Markets Group, where he is responsible for all international and domestic corporate services new business and relationship management. Prior to joining OTC Markets in October 2013, Mr. Paltrowitz was Managing Director and Segment Head at JP Morgan Chase and was responsible for the custody, clearing and collateral management business in the Corporate and Investment Bank division. Mr. Paltrowitz started his career at BNY Mellon serving in multiple senior management positions, most notably as Head of M&A for the Financial Markets and Treasury Services Sector and 11 years in the Depositary Receipt Division as the Head of the Global Capital Markets Group. Mr. Paltrowitz also served as a member of the Board of Directors at OTC Markets Group from 2008 – 2011. Thell Woods, a former interim president of the CfPA, founded and currently serves as chairman of Crowdfunding Services LLC. The company helps establish “Community Centric Crowdfunding” programs offering both non-profit and securities offerings. Thell serves specifically defined communities throughout Michigan developing the www.C3funding.com website as the base for these programs.

Thell Woods, a former interim president of the CfPA, founded and currently serves as chairman of Crowdfunding Services LLC. The company helps establish “Community Centric Crowdfunding” programs offering both non-profit and securities offerings. Thell serves specifically defined communities throughout Michigan developing the www.C3funding.com website as the base for these programs. Dr. Richard Swart is recognized as the global thought leader in the crowdfunding industry. Richard is a founding board member of the Crowdfunding Professional Association (CfPA), the Crowdfunding Intermediary Regulatory Advocates (CIFRA), and an early leader in the field. Richard co-organized the first major national conference on crowdfunding and coordinated several educational events on the JOBS Act throughout the United States for the White House.

Dr. Richard Swart is recognized as the global thought leader in the crowdfunding industry. Richard is a founding board member of the Crowdfunding Professional Association (CfPA), the Crowdfunding Intermediary Regulatory Advocates (CIFRA), and an early leader in the field. Richard co-organized the first major national conference on crowdfunding and coordinated several educational events on the JOBS Act throughout the United States for the White House. Xiaocheh Zhang currently serves on the CfPA Board of Directors. He is also a co-founder of the Crowdfunding China Society (CFCS). As a crowdfunding thought leader, he has advised many organizations in applying alternative finance and result-based approach in transforming their business models. He has provided services to World Bank, United Nations, TUEV SUED, Virginia Tech, Peking University and some other organizations in the past 15 years. Xiaochen has rich experience in both public and private sector in America, Africa, Asia, Latin America and Europe to incubate and scale up innovative programs and projects at all levels. He is also a recognized speaker in climate finance, green innovation and crowdfunding. Here are a few examples:

Xiaocheh Zhang currently serves on the CfPA Board of Directors. He is also a co-founder of the Crowdfunding China Society (CFCS). As a crowdfunding thought leader, he has advised many organizations in applying alternative finance and result-based approach in transforming their business models. He has provided services to World Bank, United Nations, TUEV SUED, Virginia Tech, Peking University and some other organizations in the past 15 years. Xiaochen has rich experience in both public and private sector in America, Africa, Asia, Latin America and Europe to incubate and scale up innovative programs and projects at all levels. He is also a recognized speaker in climate finance, green innovation and crowdfunding. Here are a few examples: Rodney Sampson is an innovator, serial entrepreneur, angel investor, published author, and consecrated bishop. As an innovator and serial entrepreneur, Sampson co-founded Multicast Media Networks (Streamingfaith.com) in 2000 (acquired in 2010), a live and on-demand streaming platform that laid the foundation for companies like YouTube and Ustream. Not stopping there, Sampson co-founded Intellectual Currency (an integrated marketing, intellectual property, diversity & inclusion and business development advisory firm) in 2002, Intellect Inspire (a digital publishing imprint of Audible) in 2006, and Legacy Opportunity Fund in 2007 with investments in technology, consumer products, energy, cyber-security, publishing and the entrepreneurial ecosystem. He also serves on the advisory boards of Digit, a disruptive financial technology company, Mark Burnett Productions, Springboard Fund and multiple startup and early stage companies throughout the world.

Rodney Sampson is an innovator, serial entrepreneur, angel investor, published author, and consecrated bishop. As an innovator and serial entrepreneur, Sampson co-founded Multicast Media Networks (Streamingfaith.com) in 2000 (acquired in 2010), a live and on-demand streaming platform that laid the foundation for companies like YouTube and Ustream. Not stopping there, Sampson co-founded Intellectual Currency (an integrated marketing, intellectual property, diversity & inclusion and business development advisory firm) in 2002, Intellect Inspire (a digital publishing imprint of Audible) in 2006, and Legacy Opportunity Fund in 2007 with investments in technology, consumer products, energy, cyber-security, publishing and the entrepreneurial ecosystem. He also serves on the advisory boards of Digit, a disruptive financial technology company, Mark Burnett Productions, Springboard Fund and multiple startup and early stage companies throughout the world. Brian Korn was elected to the Board of Directors (Legal P.O.V.) of the Crowdfunding Professional Association in January 2014. Brian is a corporate and securities attorney at the law firm Manatt, Phelps & Phillips, LLP, and has had multiple appearances on Fox Business Television, Bloomberg, CCTV America and National Public Radio as an expert on the JOBS Act, including its impact on crowdfunding, peer-to-peer lending, IPOs and market trading dynamics. He has been published or quoted in Forbes, CNBC, MSNBC, New York Law Journal, Law360, Philadelphia Inquirer, Pittsburgh Post-Gazette, The Financier Worldwide and The Review of Securities & Commodities Regulation.

Brian Korn was elected to the Board of Directors (Legal P.O.V.) of the Crowdfunding Professional Association in January 2014. Brian is a corporate and securities attorney at the law firm Manatt, Phelps & Phillips, LLP, and has had multiple appearances on Fox Business Television, Bloomberg, CCTV America and National Public Radio as an expert on the JOBS Act, including its impact on crowdfunding, peer-to-peer lending, IPOs and market trading dynamics. He has been published or quoted in Forbes, CNBC, MSNBC, New York Law Journal, Law360, Philadelphia Inquirer, Pittsburgh Post-Gazette, The Financier Worldwide and The Review of Securities & Commodities Regulation. Thomas Lawson is vice president of private issuer services for VIA Folio, Folio’s private capital network. In his role at VIA Folio, he provides legal and regulatory guidance to business development and operations. As part of this work, he supports VIA Folio’s online transactions in unlisted securities. He joined Folio in 2015.

Thomas Lawson is vice president of private issuer services for VIA Folio, Folio’s private capital network. In his role at VIA Folio, he provides legal and regulatory guidance to business development and operations. As part of this work, he supports VIA Folio’s online transactions in unlisted securities. He joined Folio in 2015. AdaPia D’Errico is the Chief Marketing Officer at Patch of Land, where she heads up marketing, which includes strategy, brand, communications, partnerships and client services. Prior to joining Patch of Land, AdaPia ran a consulting company that developed growth strategies for major brands at Disney and Mattel, as well as technology and new media startups. AdaPia began her career at CIBC and subsequently spent 8 years in banking and investment management with a focus on customer relationship management, investor relations, and corporate communications. AdaPia is a published writer, blogger for The Huffington Post, and is a public presenter on topics including growth strategies, entrepreneurship, crowdfunding and brand development. AdaPia holds a B.B.A from the University of British Columbia and a B.A in International Business Economics from Hogeschool Zeeland, The Netherlands.

AdaPia D’Errico is the Chief Marketing Officer at Patch of Land, where she heads up marketing, which includes strategy, brand, communications, partnerships and client services. Prior to joining Patch of Land, AdaPia ran a consulting company that developed growth strategies for major brands at Disney and Mattel, as well as technology and new media startups. AdaPia began her career at CIBC and subsequently spent 8 years in banking and investment management with a focus on customer relationship management, investor relations, and corporate communications. AdaPia is a published writer, blogger for The Huffington Post, and is a public presenter on topics including growth strategies, entrepreneurship, crowdfunding and brand development. AdaPia holds a B.B.A from the University of British Columbia and a B.A in International Business Economics from Hogeschool Zeeland, The Netherlands. Dara Albright is a recognized authority, thought provoker and frequent speaker on topics relating to market structure, private secondary transactions, next-gen IPOs, P2P, FinTech and crowdfinance. Albright has held a distinguished 23 year career in IPO execution, investment banking, corporate communications, financial marketing as well as institutional and retail sales.

Dara Albright is a recognized authority, thought provoker and frequent speaker on topics relating to market structure, private secondary transactions, next-gen IPOs, P2P, FinTech and crowdfinance. Albright has held a distinguished 23 year career in IPO execution, investment banking, corporate communications, financial marketing as well as institutional and retail sales.

CfPA BOD Keynote at World’s Largest CrowdFunding Summit

Entrepreneurship @ University: Role of Crowdfunding

Entrepreneurship @ University: Role of Crowdfunding

CfPA President, Scott McIntyre, addresses the International Crowdfunding Conference in Coimbatore, India, January 2016. Subject: Student Entrepreneurship Powered by Crowdfunding. More info here

Crowdfunding Conference 2016

The Largest Event for Reg A+, General Solicitation Techniques, and Raising Capital Online

The Crowdfunding Professional Association is pleased to be a supporting sponsor of The Crowdfunding Conference 2016. The Early Registration Discount of $300 is expiring this Friday. You can register at the following link: http://crowdfundingconference.com

DealFlow Events is adding new speakers to the agenda every day. Below are the first speakers to be announced before the Early Registration Discount expires.

Howard Morgan

First Round Capital

Co-founder, Partner

Fabrice Grinda

FJ Labs

Co-founder, Partner

Rory Eakin

CircleUp

Founder, COO

Jon Medved

OurCrowd

CEO

Dan Ciporin

Canaan Partners

General Partner

Slava Rubin

Indiegogo

Founder

Tim Draper

Draper Fisher Jurvetson

Founder, Managing Director

Bradley Harrison

Scout Ventures

Founder, Partner

Doug Ellenoff

Ellenoff Grossman & Schole

Partner

Yoel Goldfeder

VStock Transfer

CEO

David Teten

ff Venture Capital

Partner

Phil Nadel

Barbara Corcoran Venture Partners

Co-founder, Partner

Zack Miller

Tradestreaming

Founder, Editor in Chief

Lou Bevilacqua

Bevilacqua PLLC

Partner

Peter Lehrman

Axial

Founder, CEO

Kendrick Nguyen

Republic

Co-founder, CEO

John Berlau

Competitive Enterprise Institute

Senior Fellow

Sara Hanks

CrowdCheck

Founder, CEO

Lou Kerner

Flight VC

Partner

Mark Elenowitz

BANQ / TriPoint Global Equities

Founder, CEO

Andrew Dix

Crowdfund Insider

Founder, CEO

Neil DeSena

SenaHill Partners

Managing Partner

Anya Coverman

NASAA

Deputy Director of Policy and Associate GC

Anthony Hill

Intralinks Dealnexus

Director

David Feldman

Duane Morris

Partner

Karen Kerrigan

Small Business & Entrepreneurship Council

President

Mike Norman

Wefunder

Co-founder, President

Steven Lord

FINAlternatives

Editor

Thanks to our corporate sponsors for their support and collaboration in making CFC16 a success.

Register before July 15 and you’ll receive an early registration discount of $300.

For a limited time, registration is only $895.

If you would like to email or fax your registration, click here.

© DealFlow Media, Inc. (d/b/a DealFlow Events). All rights reserved. Dealflow.com®, DealFlow Events™, and The Crowdfunding Conference™ are trademarks of DealFlow Media, Inc.

This email was sent by: DealFlow

131 Jericho Turnpike Jericho, NY 11753

Tel (516) 876-8006

http://dealflow.com

Click here to leave this mailing list.

Gate Global Impact Partners With U.N. To Capitalize Social Entrepreneurs

Gate Global Impact announced at the recent United Nations Global Compact Leaders Summit a plan to feature select companies from the U.N.’s soon-to-be-launched Social Enterprise Action Hub on the Gate Global Impact GATEWAY Platform, a crowdfunding platform for social entrepreneurs to pitch impact investors…

See Full Article

Why Crowdfunding Will Explode In 2013

The world of entrepreneurial finance is changing rapidly; we are at a tipping point that will make what seems like a vibrant part of our global economy today seem small in one year’s hindsight.

Whether you are a service provider, social entrepreneur, angel investor, venture capitalist, or one of the millions of people ready to become a small-scale start up financier, it is time to pay attention.

Estimates for annual crowdfunding transactions go as high as $500 billion annually compared to 2011’s $1.5 billion (anticipated to be $3 billion in 2012). If crowdfunding even begins to approach that scale, it will completely change the landscape for start-up financing.

Read More…

Equity Crowdfunding Is Now Legal. How Can You Get Your Piece of the Action?

Equity crowdfunding in the United States is a blank slate. With equity crowdfunding’s recent legalization in the United States, many companies smell an opportunity to develop technical and financial innovations to help the industry mature.

Equity crowdfunding is much like crowdfunding, which has been popularized in the United States through sites such as Kickstarter and Indiegogo. The difference is that instead of individuals supporting campaigns through donations, numerous investors are purchasing small stakes in startups or small businesses. Critics of crowdfunding worry that the industry will be rife with Ponzi schemes or that having too many investors will hurt startups’ prospects for future funding.

Proponents of equity crowdfunding, however, point to its success in countries such as Australia and Germany. For example, Seedmatch, an equity crowdfunding platform in Germany, allows investors to enter long-term investment contracts where they get equity. Australia, where equity crowdfunding has been legal for seven years, already has a platform for “secondary” sales of unlisted issued securities.

Currently, equity crowdfunding in the United States lacks the organizations and support infrastructure, such as investor verification systems and clearing houses, needed for a thriving equity crowdfunding ecosystem.

“We are already beginning to experience the proliferation of financial innovation with secondary exchanges, investor verification systems and private securities-clearing,” Crowdnetic CEO Luan Cox said. “I believe that as the infrastructure matures, more and more financial service providers will adopt crowdfinance and the industry will rapidly develop into a viable asset class.”

Companies such as Finagraph are helping investors cut through the opaque fog often associated with investing in startups. They provide a portal that will allow investors to analyze companies’ current financial health. According to MIT Profssor Christian Catalini, creating more transparency and developing trust will be essential for equity crowdfunding’s success.

“It will be interesting to see how the ecosystem around equity crowdfunding platforms will evolve,” he said. “There is an opportunity for third-party intermediaries to provide certification (e.g., on the technical feasibility of an hardware project) and quality ratings in the market to improve its efficiency. A trustworthy intermediary would increase the number of transactions that can actually take place. Platforms will experiment with different forms of market design and rules, in an effort to select only projects that meet a certain quality level.”

Catalini already sees some healthy equity crowdfunding experimentation that will help the industry mature.

“This will spawn a number of innovations, as traditional institutions and new ones start experimenting with how to bring crowdfunding to the next level,” he continued. “We will see some failures, and we will learn from them in an effort to develop better regulation. It will be interesting to see how crowd due diligence on projects will evolve, as right now it mostly relies on one or a few lead investors taking the lead on the activity. Interestingly, platforms like AngelList are already experimenting with ways to encourage talented investors to use their skills and scale their operations by allowing others to co-invest, and incentives are aligned because they get a carry on the investment.”

One glaring obstacle, according to Director of Research Richard Swart, who oversees crowdfunding research at Berkeley, is the lack of crowdfunding auditors.

“There also needs to be a better way of doing financial audits,” Swart said. “There’s a big gap in the market when it comes to auditing small businesses or early-stage startups. The Big Four accounting firms just don’t have it covered yet. Most startups don’t have great financial accounting. It will take some time for the market to mature. You will probably see institutional investors experiment with equity crowdfunding before you see individual investors. 90% of America doesn’t even know what equity crowdfunding is.”

Swart believes equity crowdfunding will be attractive to “Main Street USA” businesses with loyal customers, but especially attractive to tech startups that do not want to deal with venture capital funds.

“I wouldn’t be surprised if we saw large pools of investment, say 20-40 million dollars,” he said. “They might just find that the costs of capital are much lower with equity crowdfunding. It’s better than dealing with VCs. A lot of people are worried that equity crowdfunding might create problems for startups who later want to seek venture capital money. However, you might see a new convertible instrument, where instead of debt being converted to equity, you will see equity turned into debt. The debt will have a much higher interest rate, so as to make it attractive to the earlier investors, and so that VCs will be wiling to invest in certain companies.”

While opportunities in equity crowdfunding exist, University of Virginia Law Professor Edmund Kitch warns that simpler securities laws are necessary for equity crowdfunding to truly thrive.

“If crowdfunding is to flourish the most obvious need is for a skillfully curated web site that will review projects and their promoters to ensure that they are honest and have the basic skills to succeed,” he said. ”Such web sites are unlikely to develop if the government stands in the way. If the government would simply create an open space for crowdfunding sites to operate, it could monitor their development and if it identified specific problems that create the need for targeted legal intervention, it could then pursue that intervention. Unfortunately, the JOBS Act is enacted within the regulatory complexity of current securities law, and does not accomplish this simple goal.”

Read More From NerdWallet:

How to Open An Online Brokerage Account in 5 Steps

Study: 81% of Americans Don’t Know How to Open an Online Brokerage Account

Crowdfunding Road Map Founder Ruth Hedges Interviewed (Video)

Ruth Hedges, Founder and CEO of Funding Roadmap and one of the early investment crowdfunding advocates, is interviewed by Devin Thorpe – a frequent Forbes contributor who covers “impact investing”.

Read More…

CfPA Sponsored Crowd Investing Forum To Take Place This Week

The Crowdfunding Professional Association’s (CfPA) 2nd Annual Crowd Investing Innovation Forum will convene top crowdfunding pioneers, policymakers, entrepreneurs and investors in Orlando on August 8th through 9th to address the most urgent issues in capital formation and job creation, corporate and entrepreneurial crowdfunding initiatives.

Following the July 11th rule change by the SEC, the JOBS (Jumpstart Our Business Startups) Act of 2012 now allows for private companies to actively solicit investment in the media and online, giving accredited investors easy access to private equity deals. The crowdfunding industry is coming together here for the first time since the rule change. The conference is timed to spark innovation and frank discussion on how investors and emerging companies both can take advantage of new crowdfunding opportunities.

Read More…

TubeStart Increases Funding for YouTube Content Creators With Launch of Subscription-Based Crowdfunding Platform

TubeStart announced today that it will be waiving fees for content creators that sign up campaigns during the first 2 weeks of August. The new platform will provide the more than 1 million YouTube creators from 30 countries with the opportunity to run both traditional rewards based and royalty-based crowdfunding campaigns, as well as launch “unique-to-market” subscription-based crowdfunding campaigns for driving ongoing revenue. Both established YouTube producers as well as creative newcomers will be able to tap into this new crowdfunding model provided by TubeStart. Read More…

Crowdfunding Professional Association Lauds SEC Approval of General Solicitation

The Crowdfunding Professional Assocation or CfPA has issued a release sharing their appreciation of the recent progress made regarding the Jobs Act. Equity-based crowdfunding came one step closer to reality this past Wednesday as the SEC voted to lift the ban on general solicitation of private placements to accredited investors.

The SEC ruling will create a new kind of offering–a 506(c). This allows private companies and investment firms to advertise private securities offerings to accredited investors only. The SEC is still working on proposed rules for Title III, which will enable the general public to participate in equity crowdfunding.

Read More…